December 27, 2011

Federal Government Debt: Evidence of Fiscal Irresponsibility

by Dr Subramaniam Pillay

That a Budget which was tabled in a Dewan Rakyat upon October 7, 2011 was an choosing bill is very clear. There have been countless minute comments upon a Budget by politicians as well as analysts (since then). In this article, you have been usually starting to concentration upon a single of a prolonged term issues from a Budget. It concerns a augmenting debt weight of a Federal Government.

That a Budget which was tabled in a Dewan Rakyat upon October 7, 2011 was an choosing bill is very clear. There have been countless minute comments upon a Budget by politicians as well as analysts (since then). In this article, you have been usually starting to concentration upon a single of a prolonged term issues from a Budget. It concerns a augmenting debt weight of a Federal Government.

How big is a supervision debt?

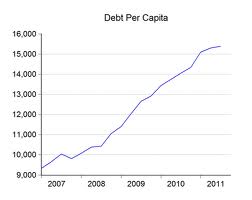

The Federal Government's superb debt has been augmenting since 1970. From a minute interpretation available from Bank Negara's website, in 1991, it reached a temporary climb of RM99 billion as well as afterwards decreased to RM90 billion by 1997. From then, it has been virtually doubling each 5 years. By a finish of 2011, you can design a figure to reach RM450 billion.

In alternative words, since a Asian crisis of 1998, you have been flourishing by borrowing heavily. In a 10 years since 1999, a debt has quadrupled. If you go upon upon this path, by 2020, a inhabitant debt will reach RM1.6 trillion. If a race is 40 million then, each Malaysian will have a debt weight of some-more than RM40,000 as well as this does not embody a own personal borrowing. Assuming an seductiveness rate of 5 per cent, profitable a seductiveness alone will price a taxpayers RM80 billion per year!

The supervision has been reassuring us by observant which a debt is manageable. It argues which a debt during a finish of 2012 will be usually 54 per cent of a GDP, which is comparatively low compared to a current crisis nations similar to Greece as well as Italy.While it might not reach a levels of Greece by 2012, during a current rate of borrowing it won't take prolonged before you turn an additional Greece. Just to put this in perspective, a hulk neighbour, Indonesia has a debt of usually twenty-three per cent of GDP! Singapore has no debts.

The Federal Government debt alone does not discuss it a full story. Many government-owned enterprises additionally have borrowings. If these figures have been included, afterwards a sum debt would be most higher. It is formidable to get a complete interpretation upon these borrowings.

Why has a debt been flourishing so rapidly?

Since a 1998 Asian Financial Crisis, supervision expenditure has consistently exceeded a income by a substantial margin. For example, in 2011 a spending is estimated to be RM229 billion whilst a income will be usually RM183 billion. So a shortfall of RM46 billion has to be met by borrowing.

Of march it is not expected which a supervision balances a books each year. Prudent economic supervision requires a supervision to shift a bill over an entire commercial operation cycle. So you can have deficits during bad years as well as bill surpluses during good years. Since 1998, you have had during least dual commercial operation cycles; yet each year though fail you have had bill deficits!

This is evidence of fiscal irresponsibility. Here is a supervision which does not know a definition of saving for a stormy day. A good example is a incident in a current year.

Ac tual income for 2011 is starting to be aloft than a budgeted figure by RM17.6 billion. This is especially due to a augmenting income from a climb in oil prices in 2011. The Federal Government relies heavily upon opposite forms of revenues (corporate tax, inorganic substance profit tax, royalties, Petronas dividends, etc) which issue from a production as well as export of oil as well as gas in Malaysia. The suit can be 30-40 per cent of a sum supervision revenue. Thus a climb in a world price of oil translates without delay into aloft income for a government. So essentially, you had a asset income.

What would a advantageous supervision do with this windfall? It would reduce a planned borrowing. But that's not a BN government's way of monetary management. Uncannily, a enlarge in a tangible spending is starting to be a same volume of RM17.6 billion!

borrowing. But that's not a BN government's way of monetary management. Uncannily, a enlarge in a tangible spending is starting to be a same volume of RM17.6 billion!

When asked about this during a single of a post-budget forums, a Treasury central explained which it was especially due to aloft spending upon salaries as well as augmenting subsidy for motor fuel as well as diesel. We can understand a augmenting subsidy though why a aloft salary? Did you usually enlarge a size of a bureaucracy? This is a transparent case of a supervision which has no carry out upon a spending.

Why is a federal supervision spending some-more than it earns?

There have been a couple of reasons for this unchanging imbalance. A major factor is a vast steam in supervision spending due to crime as well as wasteful spending which has been highlighted by a Auditor General year after year in his annual reports. It has been estimated which you can simply save RM25-30 billion though changing any of a deliverables if you can get rid of crime as well as cronyism. Transparent practices similar to ope! n tender ing can cut down a price of most of a buying as well as project spending.

In addition, spending can be reduced upon troops procurements. If a fraction of a income which is saved here can be used to improve a quality of a diplomats in Wisma Putra, you can avert any intensity hazard to inhabitant security. We can additionally cut down upon a extreme use of foreign as well as local consultants by a supervision for work which ought to be finished by a polite service. Reduction of subsidies to a operators of privatised projects such as a eccentric energy producers as well as toll highway operators will additionally narrow a deficit.

Another reason for a necessity is a underneath collection of revenues including income taxation as well as customs duties. Better compliance to as well as coercion of existent laws as well as provisions can enlarge supervision revenue.

It is usual knowledge which most commercial operation operators hedge profitable their full share of income taxation by underneath dogmatic their true income. Similarly, evasion of customs duties is rampant due to crime in a Customs department.

What will happen if a debt keeps augmenting during a same rate in future?

As a debt gets larger, seductiveness payments will take an augmenting share of sum supervision spending.

If a supervision continues with a trend of a past thirteen years, by 2020 you might be spending about 18-25 per cent of a handling bill upon seductiveness payments. In fact, as a borrowing increases, a supervision will be forced to compensate aloft seductiveness rates to borrow some-more because a credit rating will be downgraded. (For example, in Europe, currently a German supervision can! borrow during around 2 per cent per annum whilst a Italian supervision has to compensate about 7 per cent for a loans.) So a seductiveness price will climb exponentially.

If a supervision continues with a trend of a past thirteen years, by 2020 you might be spending about 18-25 per cent of a handling bill upon seductiveness payments. In fact, as a borrowing increases, a supervision will be forced to compensate aloft seductiveness rates to borrow some-more because a credit rating will be downgraded. (For example, in Europe, currently a German supervision can! borrow during around 2 per cent per annum whilst a Italian supervision has to compensate about 7 per cent for a loans.) So a seductiveness price will climb exponentially.

This will leave most reduction income for alternative social as well as economic spending. It will additionally widen income lack of harmony as a supervision will have to cut spending upon most open products similar to education, illness care as well as open transport. At a same time, a seductiveness it pays goes especially to foreigners as well as a better off segment of a population.

What is even some-more worrying is which since a vast income from petroleum-related sources, you should not really be using deficits. It is usually a matter of time before you run out of oil as well as gas as well as thus turn net importers of these dual commodities. When which happens, a bill incident might turn very critical.

A advantageous Malaysian supervision would have saved a sizeable apportionment of a inorganic substance income from a past couple of decades as a account for stormy days. Many alternative countries have finished this. Norway is a prime example. Abu Dhabi is an additional country which has a outrageous emperor resources account set up from a inorganic substance windfall. Botswana in southern Africa saved a asset earnings from a find of diamonds as well as invested it abroad for a long-term well being.

Unfortunately, you have been governed by a spendthrift supervision which is beset with problems of crime as well as incompetency. Unless a incident changes, you have been withdrawal a outrageous weight to a children as well as grandchildren. They have been not starting to pardon us if you do not try to shift a situation. aliran.com

* Dr Subramaniam Pillay, an Aliran exco member, is an accessory associate professor with a School of Business during a University of Nottingham Malaysia.

Like this:

More Barisan Nasional (BN) | Pakatan Rakyat (PR) | Sociopolitics Plus |

No comments:

Post a Comment