SEPARATED by a gap of scarcely fifteen years, a lectures by dual French managing directors of a International Monetary Fund in Kuala Lumpur Michel Camdessus as well as Christine Lagarde underscore a extensive changes in a IMF as well as Malaysia.

On Dec 2, 1997, scarcely 5 months after a conflict of a Asian crisis, Camdessus strode into a Putra World Trade Centre like a modern-day Louis XIV a French king who built Versailles as well as famously spoken "I am a state."

Titled "Rebuilding Confidence in Asia", Camdessus's debate enunciated dual propositions.

First, a predicament was caused by East Asian countries' flawed mercantile policies. Camdessus's avowal ignored a IMF's contributory role, in particular, its aggressive advocacy of monetary as well as collateral marketplace liberalisation, a process which allowed a destabilising transformation of huge sums of income into as well as out of this region.

Second, he staunchly shielded sidestep funds, speculators as well as tellurian markets.

" ... It would be a mistake to blame sidestep supports or alternative marketplace participants for a misunderstanding in Asia. Turbulence in a marketplace is usually a sign of some-more serious underlying problems, which are right away being addressed seriously in many countries," he said.

During a question-and-answer session, Camdessus swatted aside critique of IMF policies.

Martin Khor, then director of Third World Network, forked out Camdessus was inconsistent in suggesting countries should re-examine as well as shift their policies whilst unwell to need marketplac! e player s as well as a IMF to do likewise.

Noting monetary speculation hadn't been regulated, Khor also referred to monetary liberalisation had taken place too fast, before a authorities had a event to assimilate how liberalisation worked or to put in place a regulatory as well as tellurian resources infrastructure.

In a overwhelming rejoinder, Camdessus asserted "Speculation is often usually good government as well as advantageous make use of of our savings."

Camdessus was similarly dismissive when a Philippine member criticised his "blind conviction which markets are good as well as governments are bad."

Several weeks after upon vacation Kuala Lumpur, Camdessus was featured in an iconic print which showcased a IMF's unsymmetrical attribute with Asian predicament countries. Taken in Jakarta, this print shows a stern-faced Camdessus, with his arms folded across his chest, station over a seated President Suharto whilst a latter signed an agreement with a fund.

In an essay titled "Crisis of Credibility: a Declining Power of a IMF", Walden Bellow as well as Shalmali Guttal noted which inside of a couple of weeks, a Asian predicament had impoverished over a million Thais as well as a little 21 million Indonesians.

By a time Christine Lagarde impeccably dressed to avoid offending Muslim sensibilities glided into Sasana Kijang upon November 14, 2012, a Asian predicament had shredded a IMF's credibility, Malaysia's preference to levy resourceful collateral controls in 1998 had been vindicated as well as Middle East was right away economically ascendant.

Titled "Asia as well as a Promise of Economic Cooperation", Lagarde's debate was important for several reasons.

First, she lauded Bank Negara Governor Tan Sri Dr Zeti Akhtar Aziz as a single of a world's best as well as longest-serving executive bankers as well as praised Malaysia as a single of Asia's many energetic as well as innovative centres. Zeti insin! cere a t ip in front of in a executive bank among a East Asian crisis; today, she faces a hurdles acted by a Eurozone crisis.

Second, Lagarde's debate contained several references to this country, together with Malaysian writer Tan Twan Eng, former Prime Minister Tunku Abdul Rahman as well as a slogan "Malaysia, Truly Asia".

Third, her debate highlighted Asia's flourishing tellurian mercantile clout.

"Over a course of 3 decades, rising Asia's share of universe GDP jumped from 10% to 30%, vital standards rose sixfold, as well as an implausible half billion people pulled themselves out of poverty. Over a past decade alone, rising Middle East has grown by some-more than 7.5% a year," she said.

Fourth, Lagarde's was finely nuanced, distinguished a change in between fulsome praise as well as undisguised criticism. For example, she complimented Malaysia for a extensive tumble in poverty over a past couple of decades though combined income lack of harmony is right away upon a rise. And whilst good strides have been made to revoke lack of harmony in this nation in a 1970s as well as 1980s, no further reductions have been seen given then, she noted.

Fifth, distinct Camdessus, Lagarde acknowledged collateral flows can move good benefits though conceded "they can also overwhelm countries with damaging cycles of crescendos as well as crashes."

Sixth, vacating slightly from her rebuilt text, Lagarde gracefully acknowledged a fund's hostility towards Malaysia's resourceful collateral controls was "a mistake". But we all make mistakes, she said.

Seventh, Lagarde acknowledged Malaysia's leading purpose in boosting a fund's coffers an act she described as a "vote of certainty in a IMF" as well as a vote of certainty in partnership.

In short, a dual visits encapsulate this country's attribute with a IMF. In 1997, Camdessus was accessible with a then finance minister, Lagarde was warmly received by Malaysia's monetary le! aders; u sually a little years during a halt was there a lack of amity.

-thesundaily

.jpg)

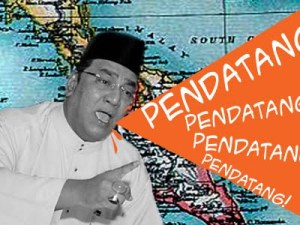

UMNO Pulau Pinang telah membuat pembohongan besar dan tidak masuk akal serta bersifat benci kaum apabila mendakwa kononnya masyarakat Melayu Pulau Pinang telah dimangsakan melalui "pembersihan etnik melalui pemajuan hartanah".

UMNO Pulau Pinang telah membuat pembohongan besar dan tidak masuk akal serta bersifat benci kaum apabila mendakwa kononnya masyarakat Melayu Pulau Pinang telah dimangsakan melalui "pembersihan etnik melalui pemajuan hartanah". rumah mampu milik yang dibina oleh kerajaan negeri Pakatan Rakyat Pulau Pinang.

rumah mampu milik yang dibina oleh kerajaan negeri Pakatan Rakyat Pulau Pinang. Menurutnya, Dato' Rahim sepatutnya akur bahawa penyelewengan tanah Melayu selama ini telah dilakukan oleh UMNO sendiri, seperti dalam kes Kampung Terang, Balik Pulau, di mana 10 ekar tanah yang dimiliki 31 orang pemilik Melayu telah dijual kepada syarikat kepunyaan dua pemimpin kanan UMNO negeri iaitu Dato' Musa Sheikh Fadzir (kiri) dan Dato' Omar Faudzar.

Menurutnya, Dato' Rahim sepatutnya akur bahawa penyelewengan tanah Melayu selama ini telah dilakukan oleh UMNO sendiri, seperti dalam kes Kampung Terang, Balik Pulau, di mana 10 ekar tanah yang dimiliki 31 orang pemilik Melayu telah dijual kepada syarikat kepunyaan dua pemimpin kanan UMNO negeri iaitu Dato' Musa Sheikh Fadzir (kiri) dan Dato' Omar Faudzar. joke keluarga di Pulau Pinang yang mempunyai pendapatan kurang daripada garis kemiskinan kebangsaan bagi Semenanjung Malaysia menjelang akhir tahun 2013.

joke keluarga di Pulau Pinang yang mempunyai pendapatan kurang daripada garis kemiskinan kebangsaan bagi Semenanjung Malaysia menjelang akhir tahun 2013.

They are a movement's cabinet members Dr Phua Kia Yaw as well as Bang Seet Peng, owners of an SUV used during a impetus - Jimmy Wong as well as his wife, Gombak PAS arch Ishak Surin, as well as MPs Tian Chua (right) as well as Sivarasa Rasiah.

They are a movement's cabinet members Dr Phua Kia Yaw as well as Bang Seet Peng, owners of an SUV used during a impetus - Jimmy Wong as well as his wife, Gombak PAS arch Ishak Surin, as well as MPs Tian Chua (right) as well as Sivarasa Rasiah. He pronounced after about an hour of doubt which although a military pronounced Ishak (left) was being questioned as a witness, he believed a questions were meant to implicate him for participating in an bootleg assembly.

He pronounced after about an hour of doubt which although a military pronounced Ishak (left) was being questioned as a witness, he believed a questions were meant to implicate him for participating in an bootleg assembly.