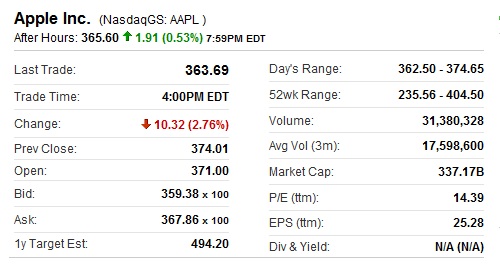

Finally, Apple Inc. (Nasdaq: AAPL, stock) is right divided officially a worlds most profitable company after a iPhone builder surpassed Exxon Mobil Corp. (NYSE: XOM, stock) early in a trade Wednesday, 10 August 2011, compartment a shutting bell. Apples marketplace capitalization is a whopping US$ 337.17 billion compared to Exxon Mobils US$ 330.77 billion. Indeed it was an amazing achievement, when about a decade ago during a 2000-2001 recession, Apple was in financial difficulty with several entertain of losses so much so which Apple was once trade during about $7 bucks a share.

Now, Apple is about $363 a share thats 5,085% appreciation inside of a camber of 10 years. Within a same period of 10-year, Exxon Mobils batch cost appreciate from a low of about $30 bucks to yesterdays shutting of $68 a share a small 126% appreciation. Of march with a volatility of wanton oil, Exxon Mobil could pass Apple once again though for now, a jubilee for a iEverything. Apples fabulous income as well as increase were basically driven by iPod, App Store, iOS, as well as of march ! iPhone a s well as iPad.

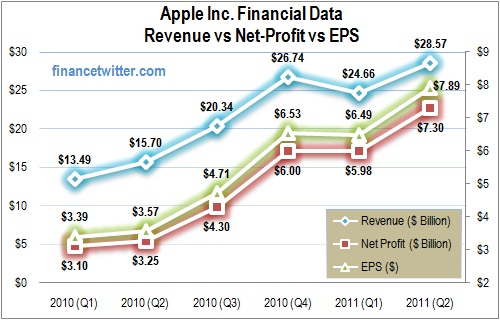

Apples re! venue, n et distinction as well as EPS (earnings per share) actually some-more than double given a initial entertain of 2010, about a single as well as half year ago. Apple grew a quarterly income from $13.49 billion in initial entertain of 2010 to $28.57 billion in a second entertain of 2011 a 111% expansion inside of eighteen months. Its quarterly net distinction expansion $3.1 billion to $7.3 billion (135% growth) whilst a EPS appreciated from $3.39 a share to $7.89 a share (132% growth); inside of a same period. If Warren Buffett were to regret for not investing in record stocks, this could be a usually batch Warren would have missed dearly.

Apple CEO Steve Jobs, who co-founded a association during a age of 21, was ousted by a board in 1985. When he returned twelve years later, Apple had run up $1.86 billion in losses over dual years. In actuality a association was 90 days divided from bankruptcy. Jobs re-engineered a companys tour to glory by revamping a industrial design, integrating program with hardware seamlessly as well as selling a beautiful gadgets such as iPod, iPhone, as well as iPad into a music, phones as well as tablets marketplace segments.

Exxon Mobil had held a top spot as a most profitable association given 2005 as well as strike a record as a association which registered a highest quarterly gain in 2008. Going by industry, Exxon Mobils organic expansion is limited since of a dependency upon brand new oil find as well as oil prices. On a other hand, Ap! ples exp ansion is limited usually by innovation, a margin it already specializes. As prolonged as Apple keeps making products or gadgets ! which peo ple wish to own, a organic expansion is limitless.

With a ultimate FOMCs preference to leave a seductiveness rate during chronological low of scarcely 0% compartment mid-2013, we dont have to be a space station scientist to predict how a oil cost would perform. So maybe a earliest Exxon Mobil can reclaim a top spot would be mid-2013; though considering Apple would in all deliver a brand new product every 3 years, 2013 being a subsequent target, Exxon Mobil may not be able to do so after all. Meanwhile, theres another trophy for Apple to squeeze a worlds largest record association by revenue, now held by Hewlett Packard.

Other Articles That May Interest You

- A Brilliant Beautiful Fake Apple Store, in China

- Apples BlockBuster Earnings, iPad Eating Up PC Market

- How Did Some Great Companies Get Their Cool Names?

- Apple, Most Valuable Brand Little Secret Of Its Dictator Celcom Launches iPhone 4 Sexy Plans vs Maxis & DIGI

- Dont Trust Gartners Smart-Phone Market Forecast