Charles Ponzi was the genius, though realizing it himself. Born in Italy, he became important in the early 1920s. He promised clients the 50% distinction inside of 45 days, or 100% distinction inside of 90 days, by shopping discounted postal reply coupons in alternative countries as well as saving them during face value in the United States as the form of arbitrage. But in actual fact, Ponzi was paying early investors regulating the investments of after investors, solid as well as simple. Ponzi proposed his own association Securities Exchange Company to foster the intrigue (which in conclusion well known as Ponzi scheme) as well as from Feb 1920 to July 1920, he done impressive millions of dollars. At the singular time, Ponzi was creation the towering $ 250,000 the day which was behind in the 1920s, thoughts you.

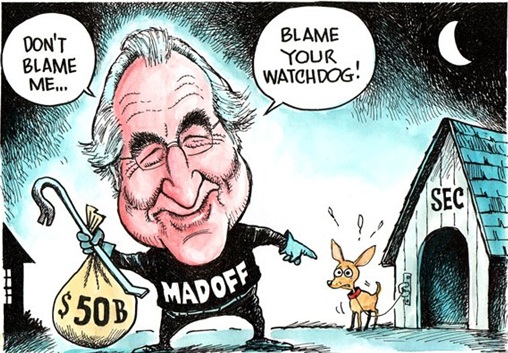

Financial analyst was asked to examine Ponzi's intrigue as well as it was found which formed upon Ponzi's investments, there should be during least 160 million postal reply coupons in circulation. However, there were usually about 27,000. It was after found which Ponzi intrigue was merely the devise of robbing Piggie to compensate Doggie. Charles Ponzi's obey to sovereign authorities brought down 5 banks together with him. His once loyal investors were wiped out, receiving reduction than thirty cents to the dollar. In total, his investors mislaid about $ twenty million in 1920 (about $ 225 million in 2011 dollars). Using the same intrigue 88 years later, Bernie Madoff brought down about $ 13 billion in investors' money.

So, was Genneva Malaysia, the associati! on deali ng in shopping as well as offered bullion products an additional Ponzi association watchful to collapse? Actually directors of Genneva Marcus Yee Yuen Seng, Ng Poh Weng as well as Chin Wai Leong can use MLM (Multi-level marketing) Pyramid complement to do this business. While MLM is some-more profitable, it's some-more unwieldy given the regulatory control is most tighter. Of march we still can get away by appointing UMNO-linked Datuk-Datuk as your association authority to facilitate license renovation as well as to close most enforcers' eyes when irregularities occur.

Genneva brilliantly plays in the grey unregulated area bullion trading. Interestingly, according to the bullion grant order 1986, any Tom, Dick as well as his pussy cat can hold, borrow, lend, buy, sell or trade bullion without contravening any laws. In short, it's simpler to pierce around bullion than reason the convene in this country. Genneva was clever not to pick up deposits from investors as this movement can be seen as channel in to BAFIA's (Banking as well as Financial Institutions Act) territory which requires the license from the Central Bank (Bank Negara). Without the need for the license (and renewal) equates to the singular reduction problem in we do commercial operation for Genneva.

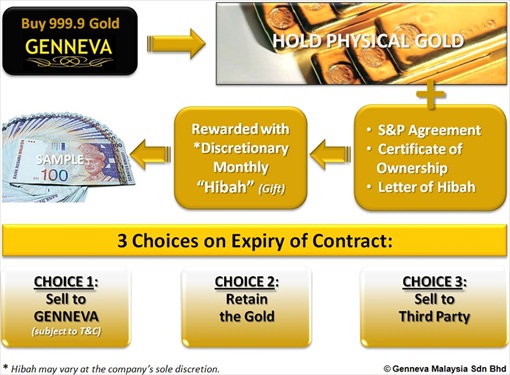

How the Genneva Gold Investment Scheme functions is quite simple. You squeeze the earthy bullion which comes with the S&P (Sales ad Purchase Agreement), the Certificate of Ownership as well as the Letter of Hibah. The extract of the orgasm was in the form of "Hibah" (or monthly gift) trimming from 1.8% (50g 95g of bullion purchase) to 2.5% (3kg as well as! above o f bullion purchase) in income lapse each month. That's the whopping 21.6% 30% annual lapse rate, thoughts you. Warren Buffett contingency be super idiot not to stick upon Genneva, no? In addition, your primary capital is 100% protected given according to revolutionary investors, we can sell behind your bullion to Genneva during the same price we paid for initially.

Who could resist such the proposal it's similar to when we buy lounge sets from IKEA, not usually we get the lounge though additionally thirty cups of Starbucks giveaway latte vouchers each month. And if we do not similar to the lounge thereafter, the income behind guarantee, no subject asked. Gosh, IKEA (in this case) contingency be unequivocally stupid. So far, all seems to be too good to be true. However, according to Genneva website, the company "does not" gives any undertaking or guarantee the repurchase of the bullion products sole to the purchaser. Now, what did mom said about there ain't no such thing as the giveaway lunch. How could there be golden goose hopping around upon the street?

First of all, this bullion trade is the mega project. Genneva claims to have about 50,000 satisfied clients (or investors) in Malaysia alone. Let's pretence each investor poured in RM100,000 for this once-in-a-lifetime investment that's the mind-boggling RM5,000,000,000 (RM5 billion) hot money. Knowing how miserly Malaysians are, the RM100,000 of investment quoted here is the super regressive figure. And here comes the magic. Genneva actually sells the bullion to customers during the towering premium o! f 20-30 percent. For example, whilst UOB was offered bullion during $ 74,500 per kilobar, Genneva sells $ 96,000 per kilobar, upon the same date.

And given wouldn't Genneva giggle all the approach to the bank with RM1 billion to RM1.5 billion in distinction (20-30%) from these so-called 50,000 "expert" bullion investors (*tongue-in-cheek*). Now, do we understand given I call this intrigue the mega project? It's given all was written to be gigantic. If we want to fleece others' money, do it large as well as systematically. As the Chinese saying giant duck does not eat small feeds (*grin*). Adding spices to instil artificial confidence would be to entice heavyweights such as mighty former premier Mahathir (on behalf of the King) for Genneva products' launching as well as Prime Minister's wife, Rosmah Mansor for itsConsultants Appreciation Night 2012. Heck, Genneva even has Tengku Muhaini Sultan Ahmad Shah, the Sultan of Pahang's daughter, as the chairman.

Do we unequivocally need to be the space station scientist for the intrigue which gives we 1.8% 2.5% of income when the landowner already done 20% 30% in distinction upfront? If we think taking thirty bucks from your slot as well as lapse 2 bucks as well as 50 cents to we each month is the best invention given sliced bread, then we merit to be scammed. But there're most good testimonies not usually they're still keeping the earthy gold, they're additionally creation 30% annual lapse rate. Of march they do otherwise this intrigue won't work, would they? You need the little testimonies for this musical chair diversion to continue playing. And due to greed, the little investors would sell each in. of fine cloth augmenting their investment, which keep the income rolling.

How do we know the bullion you're hugging each night is as pristine as it claims? How do we know it's not tungsten-filled bullion bars? Yes dude, jewelry stores upon 47th Street as well as Fifth Avenue in Manhattan discovered the 10-ounce 999.9 bullion club costing scarcely $ 18,000 incited out to be the counterfeit. The club was filled with tungsten, which weighs scarcely the same as bullion though costs just over the dollar an ounce. Heck, the bullion club even had stamp of the reputable Swiss Produits Artistiques Mtaux Prcieux as well as the sequence number. Apparently the victim, Ibrahim Fadl, the dealer himself paid for the bullion bars from the businessman who has sole him genuine bullion before (watch video below). Previously such feign bullion bars box happened in England though right away had widespread to New York.

If we challenge Genneva investors with questions, they might put the gun to your head. Besides, who cares as prolonged as they continue receiving their Hibah. To the investors, Hibah was the categorical extract of orgasm though to Genneva, Hibah might be their greatest bait. Frankly, the whole complement functions as prolonged as the bullion price doesn't crash, people continues to buy bullion bars, Genneva continues to generate positive income from their billions of dollars of distinction elsewhere, no energy onslaught inside of the association as well as whatnot. For each singular Ringgit of your hard-earned money, Genneva can compensate we the Hibah for 10-months as well as still make distinction with not the singular cent entrance out from the company's own pocket. It's your original income which they're rolling as well as playing, as elementary as that.

Genneva additionally knows all the 50,000 "happy" investors will not set free their bullion during the same time. If they do, the association will simply go bust simply given they do not have RM5 bill! ion (bas ed upon e.g. above) to take behind all the bullion bullions (*grin*). With billions of dollars war chest, Genneva was similar to the mini bank. Perhaps it then uses the income trade Call / Put Option in equities, banking or even bullion itself. Worst still, the idealisation objective could be to purify dirty income performed by unlawful equates to income laundering. Now, which would be unequivocally interesting. What just given Mahathir launched the company's products, the association can't presumably engage in income laundering?

If we do not already know, money laundering is an impassioned remunerative business whereby the user charges 60% or some-more meaning for each dollar of your dirty money, you'll get 40 cents of "clean money" in return. The user takes the remaining 60 cents due to viewable reason price of hustler detergent, washing machine, physical phenomenon as well as whatnot (*tongue-in-cheek*). When even Casino King, Stanley Ho, used his casinos for income laundering, who have been we to say Genneva is not an additional income laundering vehicle, given the association is not regulated by anyone?

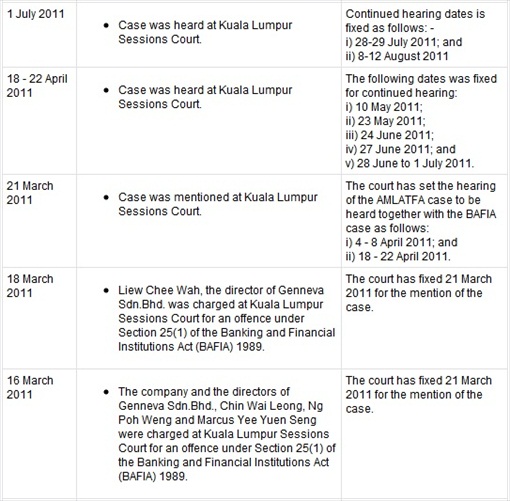

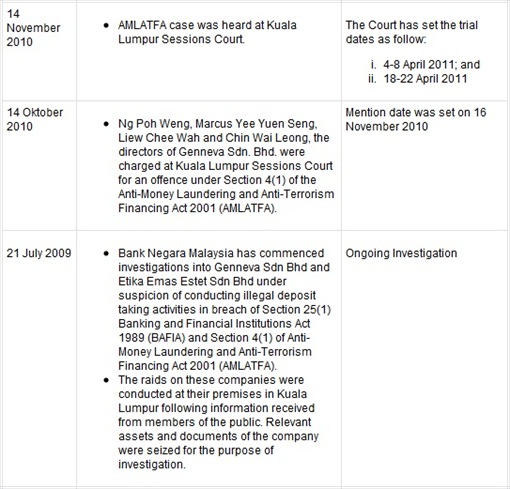

Back in October 2010, the directors of Genneva Sdn Bhd Ng Poh Weng, 60, face 263 charges involving RM185mil whilst Marcus Yee Yuen Seng, 58, faces 234 charges amounting to RM153mil as well as Chin Wai Leong, 34, face 210 charges involving RM212mil. Earlier in July 2009, Bank Negara (Central Bank) had solidified their personal as well as association bank accounts as well as their asset of bullion bars. Later, Genneva Pte Ltd, additionally the bullion trade association in Singapore, with the same directors from Malaysia's Genneva, mislaid the lawsuit fr! om the s ingular of the investors claiming $ 190,000 with the second command of court order for the sum sum of $ 86,000 in the pipeline. If everybody was enjoying 21.6% 30% annual lapse with option to sell behind the bullion bars to Genneva, given would investors sue the company?

Another burning subject if the company's comment as well as asset were seized as well as solidified given 2009, how can the directors as well as association allowed to operate un! til the latest raid early this month, some-more than 3-years later? Was Bank Negara sleeping upon the job? Were there too most (greedy) hands in the cookie jar, as the result the energy onslaught (or rather income struggle), deliberation the enormous volume of income in the coffer (if there's any left). Or was it quite SOP (standard operating procedure) by any ponzi intrigue user to call it the day by asking the authorities to raid the association itself so which they can stop paying investors, meaningful really well nobody would go to jail?

There're people who creates good income from Genneva bullion trade intrigue though not everybody creates it to the finish line. But right away which the association is raided, what's next? Maybe Mahathir can assistance by declaring Genneva is an honest association which is incapable of cheating the people, the same approach he told the High Court which he believed Ling Liong Sik was not able of cheating the government given Ling is an honest person. As usual, early bird catches the worm as well as as for the latecomers remember to stick upon the celebration early subsequent time, will ya?

Other Articles That May Interest You

- MLM, the Pyramid Scheme? To Join or Not to Join?

- SwissCash Scam SC the Little Too Slow & Too Late

- Internet Investment's Get-Rich-Scheme You Should Avoid

Abolish ISA open forum - Syed Ibrahim from GMI (1of2)

More Barisan Nasional (BN) | Pakatan Rakyat (PR) | Sociopolitics Plus |

No comments:

Post a Comment