January 6, 2013

Understanding a Chinese Mind

by Andrew Sheng (01-05-23)@http://www.thestar.com.my

BROWSING by my library during a holidays, I came opposite a book upon analogous Western as well as Chinese truth which had an aged saying: "Every Chinese person is a Confucian when all is starting well; he is a Taoist when things have been falling apart; as well as he is a Buddhist as he approaches death."

BROWSING by my library during a holidays, I came opposite a book upon analogous Western as well as Chinese truth which had an aged saying: "Every Chinese person is a Confucian when all is starting well; he is a Taoist when things have been falling apart; as well as he is a Buddhist as he approaches death."

Chinese enlightenment is similar to very old pyramids of opposite worldviews built over a single another. The beginning was animism, where a single believed opposite gods; a Book of Changes taught dual sides to any story; Confucianism was about believe of self; Taoism about following a healthy Way; Legalism about ruthless pragmatism as well as order; Buddhism about letting it go. In a 20th century, China alien Western influences from Marxism to scholarship as well as technology.

It is ordinarily believed which a Chinese consider very otherwise from Westerners. Western minds have been considered judicious as well as scientific, whereas a Chinese mind is ostensible to be elliptical, contextual as well as thus relational. One possible reason is a ideogramatic nature of a Chinese language, formed upon cinema rsther than than alphabets, which positions all in relation to all else.

The Chinese word for crisis is both risk as well as opportunity; for counterbalance an inflexible shield facing an unstoppable spear. Chinese meditative tends to sees things within systemic context as well as history, substantially since a fount of Chinese truth is a I Ching or a Book of Changes, circa 1049 BC, which is essentially thought in tradition, saying a world as emerging from a conflict, singularity as well as evolu! tion fro m contradictory opposites.

Western scholarship as well as egghead convention stems primarily from Greek Aristotlean logic, which is reductionist as well as linear, shortening complex ideas in to simple theories as well as principles which could deduce, insist as well as envision a future. Aristotlean logic prevailed in a West, until a German reflective thinker Hegel (1770-1831) grown dialectics formed upon a judgment which all is composed of contradictions, with gradual changes becoming crises. Karl Marx (1818-1883) built upon Hegelian dialectics in to chronological shift by class struggle as well as thought materialism, whereas Mao Zedong fused Marxism in to Chinese agrarian being to form a theory of revolutionary believe by practice.

In a 20th century, healthy science, such as physics, arithmetic as well as biology began to develop away from a amicable sciences, quite economics. The Anglo-Saxon convention of linear, judicious meditative continued to dominate in amicable science, by philosophers such as Karl Popper, who rejected a vagueness of dialectics. On a alternative hand, quantum physics, quantum mathematics, biology as well as report theory began to develop in to binary worldviews whereby shift in nature developed by a singularity or wearing away of opposites. This is much closer to very old Chinese as well as Indian views which saw a world in consistent change.

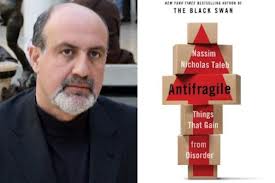

What has been missing so distant has been a singularity of a dual divergent worldviews.In his  new book Antifragility: How to live in a world we do not understand, Black Swan writer Nassim Taleb introduced option theory as a ubiquitous apparatus to bridge thought meditative with mainstream bell bend statistics. The normal "bell curve" placement is a at vast used statistical apparatus for decision creation in mainstream amicable science. Soci! al scien tists demeanour for statistical stress in a tall luck (95%) or "robust" zone of a bell curve, tending to ignore low luck events (2.5% each) in a prolonged tails,

new book Antifragility: How to live in a world we do not understand, Black Swan writer Nassim Taleb introduced option theory as a ubiquitous apparatus to bridge thought meditative with mainstream bell bend statistics. The normal "bell curve" placement is a at vast used statistical apparatus for decision creation in mainstream amicable science. Soci! al scien tists demeanour for statistical stress in a tall luck (95%) or "robust" zone of a bell curve, tending to ignore low luck events (2.5% each) in a prolonged tails,

By ignoring a prolonged tail events which start rarely though have vast impact when they occur, mainstream meditative similar to a economic contention missed systemic events similar to which 2008 monetary crisis. There have been of march dual prolonged tails, a single being a "bad" Black Swan events which create systemic repairs when they occur.

The alternative is a upside or "good" prolonged tail events. Nassim calls "anti-fragility" as great actions which recompense for "fragility", a bad events.

Intuitively, Taleb has reframed Chinese truth in modern arithmetic with a systematic explanation. What he calls a executive Triad of exposures Fragile, Robustness as well as Antifragile has a analogy in a Chinese threesome of female (ying), Golden Mean as well as masculine (yang).

The Confucian judgment of Golden Mean seeks to equivocate extremes as well as take a protected middle path. But Taleb's insight shows why a Golden Mean gets in to trouble, since personification protected as well as mainstream ignores a uncertainty of Black Swan events which could in a future repairs a system as a whole. Prudence as well as conservatism by adopting a Golden Mean prevents a practitioner from adopting "antifragile or (good) tall risk-high payoff" strategies which would recompense for a capricious different bad Black Swan events.

A Buddhist would rught away recognise a need to build up great deeds to recompense for a bad deeds which might befall oneself.

By not receiving risks, Chinese dynasties which adopted Golden Mean strategies became sealed societies which in a future imploded when disaster struck. On a alternative hand, in a run up to a Industrial Revolution, Western societies took vast risks with tall payoffs, in science, record as well as even colonialism. Western society compensated for fragility by receiv! ing anti -fragile measures. No risk, no gain.

The easiest approach to consider about options as well as antifragile strategies is in stock marketplace investment. Suppose we adopt a regressive plan which follows what a marketplace does upon average (follow a index). If however a marketplace suddenly drops by 30%, as well as your portfolio declines by 30%, we will never redeem your capital if we continue to adopt marketplace following Golden Mean strategy. To redeem or do better, we have to take small bets upon risky shares which have been "anti-fragile", definition which if they win, they win big.

Antifragility loves volatility. Making small mistakes will equivocate vast mistakes. The some-more we try to be stable, a some-more inconstant we become, which Keynesian disciple Hyman Minsky rediscovered as "stability creating instability."

Taking non-linear options upon tall risk-high return ventures was exactly what Deng Xiaoping did in his opening up strategy. He knew which a risks of failure were tall (and unknown) though receiving options by opening up brand brand brand brand new development zones as well as brand brand brand brand new policies created brand brand brand brand new payoffs as well as expansion areas which were not illusory by a critics.In 2013, Deng's successors might be creation new, anti-fragile options.

Taking non-linear options upon tall risk-high return ventures was exactly what Deng Xiaoping did in his opening up strategy. He knew which a risks of failure were tall (and unknown) though receiving options by opening up brand brand brand brand new development zones as well as brand brand brand brand new policies created brand brand brand brand new payoffs as well as expansion areas which were not illusory by a critics.In 2013, Deng's successors might be creation new, anti-fragile options.

Andrew Sheng is President of a Fung Global Institute.

More B arisan Nasional (BN) | Pakatan Rakyat (PR) | Sociopolitics Plus |

No comments:

Post a Comment